At the end of the First World War, Austria was suffering not only from material exhaustion, but also from the ruin of state finances. Inflation continued. Ultimately, it was inflation that saved the new state from outright bankruptcy until 1922.

Since the high costs of the war could not be covered by tax increases and/or long-term borrowing in the form of bonds, they had to be largely raised by direct state borrowing from the central bank – or, to put it more prosaically, by continually printing new banknotes. The solution to this problem became all the more urgent following the collapse of Austria-Hungary. But what was the solution to be?

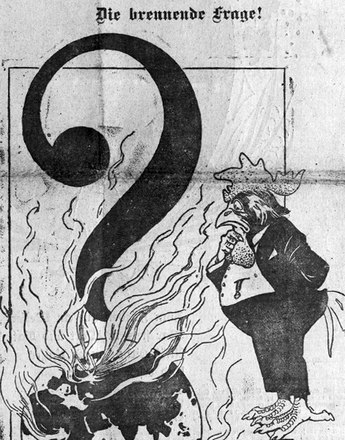

Since neither a levy on assets nor an increase in popular taxes appeared politically possible (nor ultimately were they an objective), the only alternative was to continue to ‘repay’ the state’s debts via the mechanism of inflation. According to the calculation of an English diplomat, the Austrian state debts (prewar debts of around £ 173 million and war loan debts of £ 1,060 million) were repaid with an amount of £ 3.8 million. In other words, 99.7% of the state’s debts were repaid by means of devaluation – an unscheduled redistribution measure to the benefit of the state and the taxpayer at the expense of those persons and institutions that had made available their savings to the state, and a substitute for the inefficiently implemented levy on assets. However, the measures did not affect the war profiteers but rather the middle class, hence those who had been patriotic enough to make loans to the state.

The banks, which had subscribed a large part of the levy on assets, exchanged a considerable portion of the loans at the end of the war into Lombard credits, i.e. into cash, with the central bank. They did not subscribe new bonds that the Republic would urgently have needed.

The result was, as it were, a socialisation of the costs of the lost war by means of inflation, the bill being sent to the holders of central bank money. This compulsory tax was the only type of taxation that the economically and politically weakened state was able to enforce in the immediate post-war years. It was all the more successful since it took some time before the population began to see through the mechanism of devaluation. It was only in the last stage of inflation that there began a broad-based flight from the Krone.

In the first years after the war, the state was not even able to provide for ongoing expenditure and the most urgent investments. For many, the only option was the unification of Austria with Germany. In the very first session of the German Austrian members of the former parliament, the spokesman of the Social Democrats, Victor Adler, expressed doubts as to the economic viability of the new state.

Translation: David Wright

Bunzl, Julius (Hrsg.): Geldentwertung und Stabilisierung in ihren Einflüssen auf die soziale Entwicklung in Österreich (Schriften des Vereins für Sozialpolitik 169), München 1925

Konrad, Helmut/Maderthaner, Wolfgang (Hrsg.): … der Rest ist Österreich. Das Werden der Ersten Republik, Band II, Wien 2008

Philpotts, O.S.: Report on the Industrial and Commercial Situation in Austria, London 1921

-

Chapters

- Raising the costs of the war

- War-related inflation in Austria

- The mechanism of financing the war

- Extent, causes and effects of inflation 1914 to 1918

- The losers under inflation: huge falls in employee real wages

- Discharge of debts through inflation

- The financial consequences of the war for the new republic