The costs of a war cannot be raised by the normal financing mechanisms. Ultimately, every war is financed by making excessive use of the gross national product, and the weaker the basis of a country's economy, the greater the burden caused by the war.

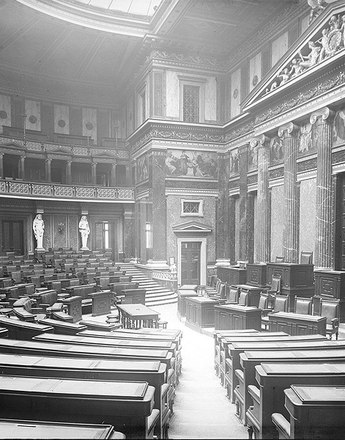

Unlike in Germany, the Austrian parliament was not convened between the start of the war in August 1914 and spring 1917. Accordingly, the consent of the legislature was not needed for the financing of the war, and the government was at liberty as to how it would proceed.

Since the assumption in summer 1914 was of a short war, the Austro-Hungarian state made use of the possibility of short-term borrowing from the central bank as resulted from the suspension of the Banking Act. To begin with, debts were contracted through the intervention of a consortium of banks that obtained refinancing from the Austro-Hungarian Bank (AHB). Subsequently, the state made direct use of the central bank. In autumn 1914 and April 1915, bills of exchange and, from summer 1915, promissory notes bearing interest at 1% per annum were issued.

In the light of the expectation of a short war, the sudden increase in the need to finance it was initially covered entirely by borrowing from the central bank. It was only in November 1914 that a first war loan (raising 2.2 billion Krone in Cisleithania and 1.2 billion in Hungary) was issued, followed by a further seven before the end of the war, raising a total of 35 billion Krone (in Cisleithania). In Hungary, 17 war loans were issued (raising 18 billion Krone).

The most prominent feature of the war economy in the financial sector was the rapid increase in the amount of money in circulation, which rose from 2.5 billion Krone (25 July 1914) to 6.5 billion (31 December 1914), hence by around 4 billion in five months. By June 1917, the debt with the central bank had risen to 10 billion Krone, increasing even more rapidly thereafter. From March 1918, the state had to have recourse to the central bank every month. From 20 March to 14 October 1918, the national debt increased by a total of 10.5 billion Krone.

At first sight, it might seem surprising that the internal devaluation of the Krone (by a factor of 16 by the end of the war!) was not reflected in an equally massive devaluation as against stable foreign currencies like the Swiss franc or the US dollar. The reason was that foreign monetary transactions and trade had been subjected to far-reaching controls as early as August 1914. Since they did not work completely, however, the gold reserves of the Austro-Hungarian Bank steadily decreased, falling from 1,055 million Krone at the end of 1914 to 684 million at the end of 1915. On 31 October 1918, they had fallen to 268 million Krone, while the bank notes in circulation had risen to 31.5 billion Krone. At the end of the war, less than 1% of the notes in circulation were covered by gold.

The foreign exchange controls and repeated state borrowings from neutral foreign countries and the German Reich meant that the devaluation of the Krone against foreign countries remained within relatively narrow limits. The result was that the internal value of the Krone became detached from the external value, a phenomenon that continued after the end of the war up to the last stage of hyperinflation in 1922.

Translation: David Wright

März, Eduard: Österreichische Bankpolitik in der Zeit der großen Wende 1913–1923, Wien 1981

Popovics, Alexander: Das Geldwesen im Kriege, Wien 1925

-

Chapters

- Raising the costs of the war

- War-related inflation in Austria

- The mechanism of financing the war

- Extent, causes and effects of inflation 1914 to 1918

- The losers under inflation: huge falls in employee real wages

- Discharge of debts through inflation

- The financial consequences of the war for the new republic