Extent, causes and effects of inflation 1914 to 1918

The rate of inflation in the war was huge: prices rose on average by 100 % per year, in other words in total by a factor of 16. Nevertheless, this age was not (yet) one of hyperinflation.

Even before the First World War broke out, Austria had been plagued by the phenomenon of rising prices. During the war, this moderate devaluation shifted into the stage of galloping inflation. However, it was only at the end of the inflation period, in 1922, that figures were reached that make it appropriate to speak of hyperinflation. There are various definitions of hyperinflation. According to Philip Kagan, hyperinflation is when the price increases amount to more than 100% in a month, the equivalent of 13,000% in a year.

However, even a relatively high rate of inflation need not necessarily only have negative consequences. These as a rule only arise after a long period of devaluation. A secondary effect of inflation for instance is the increase in cash flow as a result of higher profits. Enterprises connected to the armaments sector in particular were therefore able to pay off their debts to the banks in the first years of the war. This in turn meant that the banks were, in the absence of alternative investment opportunities, all the more willing to make this money available to the state by subscribing war loans. The banks were the largest subscribers of the war loans, followed by industrial enterprises. In contrast, private individuals only played an essential role at the beginning.

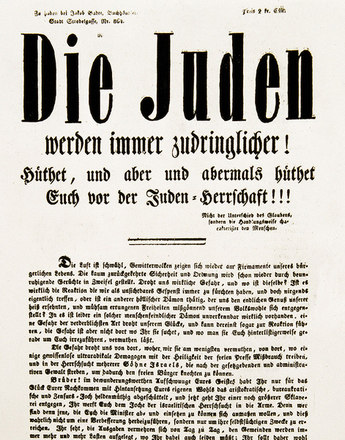

The war economy also led to the development of a new class of entrepreneur-speculators, who very quickly accumulated great wealth. The rise of Camillo Castiglioni, Siegfried Bosel and other nouveaux riches was closely related to the First World War. Huge profits resulted not only from the direct business with armaments, but also from other supplies to the army such as uniforms, food and beer, which was brought to the front refrigerated. The display of wealth soon caused bad blood and stirred up anti-Semitic resentment, which was also exploited by politics. Indirectly, there was also a shifting of assets to the luxury industry; thus production in the women’s haberdashery industry in Vienna was 50% higher in 1917 and 75% higher in the first half of 1918 than in 1914.

The war profiteers also included agriculture, not only as a result of the increasing prices for food and the possibility of selling goods on the black market, but also because devaluation meant that old debts could be paid back in devalued money.

There were, however, also those who lost considerably as a result of inflation. These included both wage earners and all recipients of fixed incomes, in particular broad sectors of the civil service and pensioners. The war also started a process with respect to the distribution of income that continued after October/November 1918. The extent to which the process of inflation also triggered a development that implied investment activities extending beyond the end of the war has not been sufficiently examined.

In general, it can be said that the increasing shortage of resources led to an increase of inflationary pressure as the war continued and that investments constituted a possibility of escaping monetary devaluation.

Translation: David Wright

Kagan, Phillip: The Monetary Dynamics of Hyperinflation, in: Friedman, Milton (Hrsg.): Studies in the Quantity Theory of Money, Chicago 1956

März, Eduard: Österreichische Bankpolitik in der Zeit der großen Wende 1913–1923, Wien 1981

Suppanz, Christian: Die österreichische Inflation 1918–1922 (Forschungsbericht Nr. 111 des Instituts für Höhere Studien), Wien November 1976

-

Chapters

- Raising the costs of the war

- War-related inflation in Austria

- The mechanism of financing the war

- Extent, causes and effects of inflation 1914 to 1918

- The losers under inflation: huge falls in employee real wages

- Discharge of debts through inflation

- The financial consequences of the war for the new republic